Protocol Overview

A high-level overview of the KuSwap Decentralized Exchange

KuSwap v3 in a Nutshell

KuSwap has consistently demonstrated its ability to adapt to the dynamic challenges of the DeFi development landscape. The latest manifestation of this adaptability is KuSwap v3, a platform that integrates governance and incentive alignment to make it the most efficient and low-cost platform.

Incentivization of Liquidity

CHALLENGES ADDRESSED

Conventional DEXes have proved costly to maintain, resulting to emissions being sold off.

Not all pairs require huge amounts of liquidity at all times.

Independent projects have no way of incentivizing provision of their own liquidity.

SOLUTION

KuSwap v3 utilizes governance mechanisms to regulate the emissions of the platform. This is achieved by adjusting the emissions through the governance token (veKUS) and aligning incentives by giving 100% of the fees and bribes to veKUS holders.

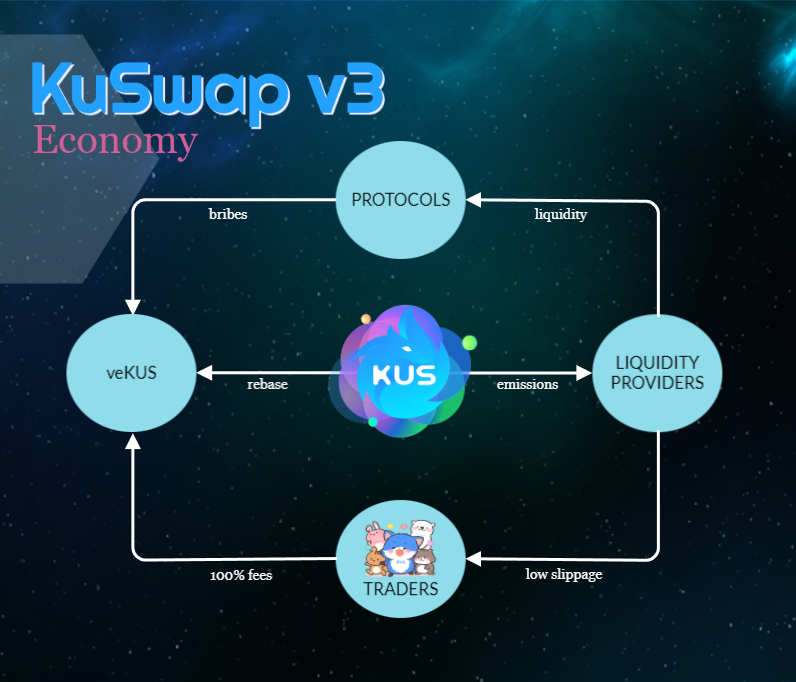

The KuSwap v3 Economy

The KuSwap Economy aligns the incentives among the different participants in the platform: The KuSwap DEX, Liquidity Providers, veKUS Holders, Traders, and other protocols.

Let's Dive Deep from the perspective of each one.

KuSwap v3 - $KUSv3

KuSwap provides emissions to Liquidity providers based on the gauge voting done by veKUS Holders.

KuSwap provides KUSv3 tokens to veKUS Holders in the form of rebases (Rebase tokens add to their locked amount).

KuSwap enjoys a higher liquidity from liquidity providers and due to liquidity incentivization and bribes.

Liquidity Providers

Liquidity providers provide liquidity to the platform by depositing liquidity in Liquidity Pools (LP). They may also provide liquidity to other protocols and projects.

The liquidity they provide makes low slippage swapping possible.

Liquidity Providers receive KUS.

Liquidity Providers can lock their KUS earnings into veKUS and vote for their own pools to get a higher share of emissions.

veKUS

KUSv3 emissions can be locked to veKUS.

veKUS decides the amount of emissions each pool receives through gauge voting.

veKUS receives the following benefits:

receives fees from the pools they vote for

receives bribes to the pools they vote for

receives rebase

veKUS holders receive a rebase proportional to epoch LP emissions and the ratio of veKUS to veKUS supply, thus reducing vote power dilution for veKUS!

The weekly rebase amount is calculated with the following formula:

(veKUS.totalSupply ÷ KUSv3.totalsupply)³ × 0.5 × Emissions

Since veKUS receives the fees and bribes for the pools they vote for, it makes sense that they vote for the pools that are actually being used for swapping or for pools that have bribe offers.

BRIBES Bribes are additional sources of revenue for veKUS holders. Since veKUS holders decide which pools receives the emissions, 3rd part projects can offer bribes so that veKUS votes for them.

Protocols

Protocols can offer bribes to veKUS holders.

veKUS holders will then vote for the protocols to get the bribes.

veKUS votes will give KUS emissions to the liquidity providers of the protocol.

The Protocol receives liquidity due to incentivization.

Traders

Since liquidity is incentivized, traders enjoy a lower slippage.

The fees that traders pay are distributed to veKUS Holders.

Economy Design

Since the swap fees go to veKUS holders, they are incentivized to properly direct the emissions to the LPs that are actually being used for swaps. This makes the platform capital efficient.

Since the bribes go to veKUS holders, 3rd party projects are incentivized to offer bribes to veKUS holders.

LPs are incentivized to lock their KUS earnings into veKUS so that they can vote for the pools they are providing for and earn more KUS.

Since all the entities involved (Liquidity Providers, Core Developers, KUS holders, and 3rd party projects) are incentivized to lock into veKUS, the major earnings from the platform is expected to come from fees and bribes, a.k.a. RealYield.

Velodromes Changes: Tying Rewards with Emissions

Voters to make only one "active" voting decision (i.e.

Voter.vote(),Voter.reset()) every epoch.Additionally, bribes from fees (internal) and external sources (external) are treated slightly different. Internal bribes are extracted from each swap and are converted to external bribes for that specific pool. External bribes are rewarded per epoch and are claimable only after the next epoch starts, when all votes are tallied. This means that a bribe sent at the last minute of an epoch will accrue to all voters of that epoch, and be claimable once the epoch flips. (This is no longer valid on Velocimeter.)

Further Velodrome adopted features

In Solidly, protocol emissions decayed too quickly, leading to minimal incentives for late entrants. Obviously early adopters should be rewarded for the risks they're taking, but we observed that the emissions decayed too quickly in the Solidly model. As a result, we made a few small tweaks to ensure that while early adopters would still be rewarded, the protocol would still be an attractive opportunity for future protocols.

First, we modified the emissions growth function to

(veKUS.totalSupply ÷ KUSv3.totalsupply)³ × 0.5 × Emissions

Second, there is no negative voting.

Third, there is no emissions "boost" for voters.

Fourth, the initial distribution has been carefully selected to include partner protocols that were felt would bring their own types of unique value to the ecosystem.

Here is a link to Velodrome Finance 🚴♀️💨🌈

Last updated